Two top dividend growth stocks from Finland

Harvia and Orion: Quality Finnish companies combining reliable dividends with long-term growth potential

In this article, we dive into two Finnish stocks you’ve probably never heard of: Harvia Oyj and Orion Oyj. We have, of course—because both have a remarkable track record when it comes to dividends. But that’s just the starting point.

Key Points

Both Harvia and Orion trading near all time highs in Helsinki

Annual dividend increases and record dividends in 2025

Both stock rank high on EBIT-margin, ROIC, revenue growth, financial strength and many more metrics (see below)

Recently, we ran a comprehensive screen using our data provider, applying strict filters across a range of key financial metrics. We weren’t just looking for any dividend payer—we were after quality compounders with serious financial discipline and growth potential.

Here’s a taste of the criteria we used, with focus on the stocks with the highest rank based on:

EBIT Margin

Free Cash Flow Yield

Dividend Yield

Market Capitalization (USD)

Return on Invested Capital

Net Debt to EBITDA

Dividend Payout Ratio

Next Year’s Revenue Growth Estimate

Dividend Per Share Growth Estimate

Only a handful of companies made it through this high-quality screen—and two of them are Finnish names we’ve been tracking for years. Quiet, consistent dividend growers hiding in plain sight.

In this piece, we’ll highlight why these companies made the cut, what the financials are telling us, and why they deserve a place on any serious dividend investor’s watchlist.

HARVIA OYJ

Harvia is a Finnish company founded in 1950 and is one of the world’s leading providers of sauna and spa solutions. The company designs and manufactures a wide range of products, including electric and wood-burning sauna heaters, complete sauna rooms, steam rooms, hot tubs, and related accessories. Harvia serves both private and professional customers, offering solutions for home use as well as hotels, gyms, and wellness centers.

With operations in over 90 countries, Harvia combines traditional Finnish sauna culture with modern design, smart technology, and a focus on health and well-being. Its portfolio includes several brands—such as Harvia, EOS, Kirami, and Almost Heaven Saunas—each targeting different customer needs and markets. The company emphasizes quality, energy efficiency, and a full-service approach, from individual products to turnkey wellness experiences.

Harvia stock bounced strong in 2024 and 2025 following a post covid crash and now approaches its all time high with a current stock price of €51.90.

Key statistics for Harvia as of July 26, 2025

Market cap: €971 million

Dividend Yield: 1.5%

Forward p/e (2025): 32

Revenue growth 2024: +16.4% to €175 million

Revenue growth 2025 (est): +15% to €201 million

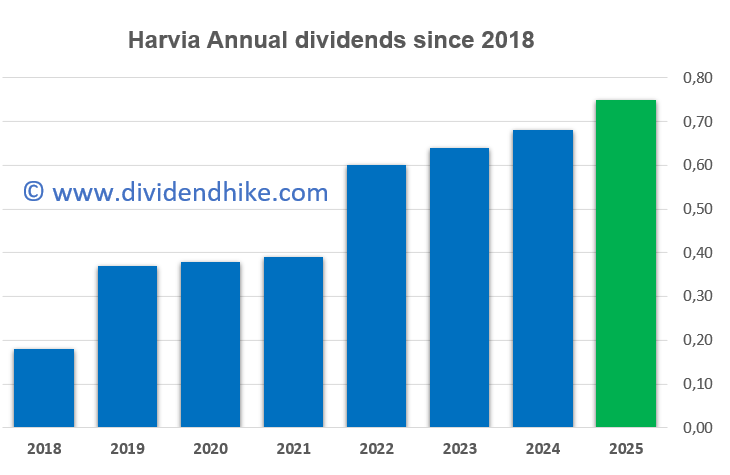

Harvia did a 10.3% dividend hike in 2025

The fun thing is that Harvia pays semi-annual dividends, which is kind of rare for Nordic stocks. The next ex-date for Harvia is October 20, 2025 for the 37 cent per share final dividend.

The average dividend hike in the last five years was a strong 15%. Harvia stock was a great buy the dips opportunity just a few years ago with the stock trading below €15.00 per share.

ORION OYJ

Orion is a Finnish pharmaceutical company founded in 1917, headquartered in Espoo. It develops, manufactures, and markets human and veterinary medicines, self-care products, and active pharmaceutical ingredients. Orion focuses its research on key areas such as oncology, pain, neurology, and respiratory diseases.

The company’s production and R&D are mainly based in Finland, with additional research operations in the UK. Orion has a strong presence across Europe and sells its products globally through partners in over 100 countries. It also includes Fermion, which supplies active ingredients, and Orion Diagnostica, specializing in diagnostic tests.

Orion combines scientific innovation with over a century of experience to promote health and well-being worldwide.

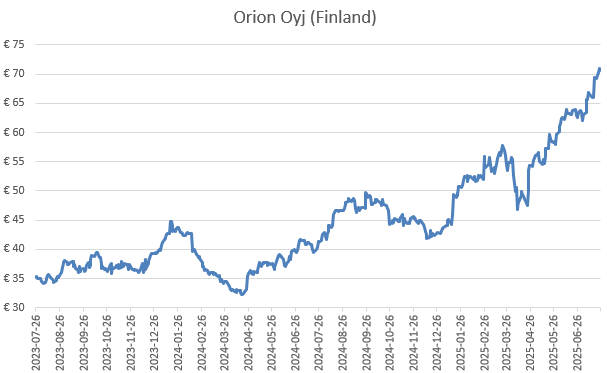

The stock is doing great in 2025 with a whopping 65% gain at a stock price of €70.55, trading at an all time high in Helsinki. The current market cap is exactly €10 billion.

Key statistics for Orion Oyj as of July 26, 2025

Market cap: €10 billion

Dividend Yield: 1.5%

Forward p/e (2025): 23

Revenue growth 2024: +29.7% to €1.77 billion

Revenue growth 2025 (est): +15.2% to €201 million

Orion did a 1.2% dividend hike in 2025

Orion also pays a semi-annual dividend to shareholders since last year. The next dividend is €0.82 per share. This final dividend will be paid on October 23, 2025. Orion is not the typical dividend growth monster you expect when you look at the stock price and other strong (growth) metrics.

The company hiked its dividend by just 1.8% on average in the last five years. On July 18, 2025, Orion reported stronger than expected revenues for the second quarter, sending the stock up 5%.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.