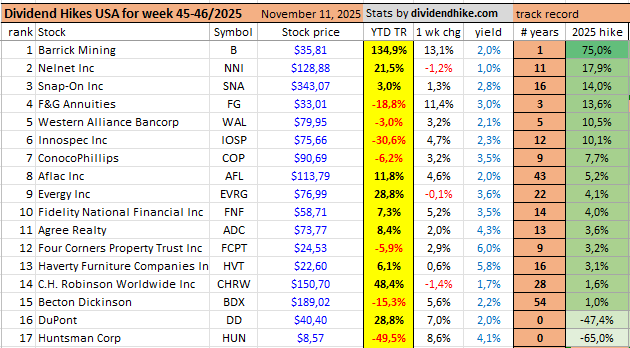

U.S. Dividend hikes & cuts– Week 45/46 (November 3–11, 2025)

Aflac, Becton Dickinson and Snap-on lift payouts as Barrick and International Seaways issue special dividends

The first half of November brought a mix of strong dividend hikes and several notable cuts across the U.S. market. Between November 3 and 11, companies from energy to healthcare adjusted payouts, including several long-running Dividend Aristocrats and two surprise special dividends.

Key Points

Aflac (AFL) and Becton Dickinson (BDX) extended multi-decade dividend growth streaks

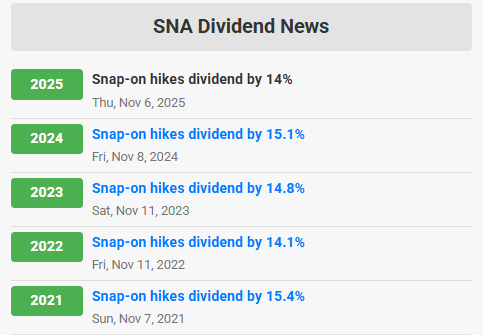

Snap-on (SNA) posted another double-digit hike, leading all raisers in 5-year CAGR

Barrick Mining (B) delivered the largest increase and announced an additional special dividend

International Seaways (INSW) declared another special dividend, reinforcing its “Special Dividend King” status

Dupont (DD) and Huntsman (HUN) cut dividends sharply within the chemical sector

Innospec (IOSP) raised its payout by 10% despite a 30% year-to-date share price drop

Among the highlights, Barrick Mining (B) stood out with the largest dividend hike of the period, accompanied by the announcement of a special dividend. The miner has gained over 130% year-to-date, offering a 2.0% yield and an impressive five-year CAGR of 14.2%.

In financials, Aflac (AFL) and Western Alliance Bancorp (WAL) continued their steady track records. Aflac, a Dividend Aristocrat, maintained double-digit long-term growth with a five-year CAGR of 13.1% and a 2% yield, while Western Alliance kept its dividend growth rate near 11%. F&G Annuities (FG) also raised its payout, offering a 3% yield despite weaker share performance this year.

Healthcare giant Becton Dickinson (BDX) extended its multi-decade growth streak, maintaining a 2.2% yield and a 4.8% five-year CAGR, demonstrating consistency amid a challenging sector backdrop. However, for Becton this also was the smallest dividend hike on record.

In the industrial space, Snap-on (SNA) once again delivered a double-digit dividend increase — the highest five-year CAGR of any company this week at 14.7%. C.H. Robinson (CHRW) and Haverty Furniture (HVT) followed with modest hikes, continuing the steady expansion of payouts across the manufacturing sector.

The chemical industry, by contrast, saw two of the most severe dividend cuts of the year. Dupont (DD) and Huntsman (HUN) both reduced distributions amid weak earnings momentum, with Huntsman’s five-year CAGR now at –11.6%.

Elsewhere, Innospec (IOSP) raised its dividend the second time in 2025, bringing the total hike to 10% in 2025, despite being down more than 30% year-to-date, an interesting signal of confidence from management. ConocoPhillips (COP) also lifted its payout, yielding 3.5% with a 14.3% five-year CAGR, while Agree Realty (ADC), Four Corners Property Trust (FCPT), and Evergy (EVRG) added modest increases across REIT and utility sectors.

👑 The Special Dividend King: International Seaways

In 2025, International Seaways (INSW) has established itself as one of the most consistent issuers of special dividends. The New York-based crude and product tanker operator has now declared four special dividends this year, continuing a shareholder-friendly capital return policy that combines regular and supplemental payments each quarter.

The period also featured two special dividend stories: International Seaways (INSW) once again rewarded investors with an additional payout — detailed in this DividendHike.com feature — reinforcing its nickname as the Special Dividend King, and Barrick Mining joined with its own extra distribution to shareholders.

Overall, Week 45 reflected the two sides of dividend momentum heading into year-end: resilient growth from long-term payers like Aflac and Snap-on, and renewed caution from more cyclical sectors such as chemicals.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.