🗓️ U.S. Dividend Hikes – Week 44 of 2025

Exxon Mobil, AbbVie, Simon Property and more announce dividend increases across key sectors

The last weeks of October 2025 and the first days of November 2025 brought a wave of dividend announcements across major U.S. industries, with dozens of companies raising payouts — from large energy and healthcare names to smaller regional banks and industrial firms.

Highlights

More than 25 U.S. companies raised dividends in Week 44

Exxon Mobil and AbbVie extended multi-year dividend growth streaks

OnespaWorld and Western Digital posted the biggest percentage hikes (25%)

CRA International increased its payout by 16.3%

Western Alliance Bancorp (WAL) lifted its quarterly dividend by 10.5%, extending its steady track record since the pandemic. Simon Property Group (SPG) followed with a 2.3% raise, continuing the gradual upward path seen in large retail REITs. AbbVie (ABBV) declared a 5.5% increase, marking its twelfth straight year of dividend growth. Energy major Exxon Mobil (XOM) raised its payout by 4%, in line with its long-standing policy of modest, consistent growth, while Entergy (ETR) announced a 6.7% increase.

OneMain Holdings (OMF) announced a small 1% lift, while OnespaWorld Holdings (OSW) surprised investors with a 25% hike — one of the largest this month. BOK Financial (BOKF) raised its dividend by 10.5%, supported by stable banking fundamentals. Cognex (CGNX) approved a 6.3% increase, and Timberland Bancorp (TSBK) announced a 7.7% hike, continuing the trend among regional lenders.

Find all recent dividend updates at www.dividendtrackrecords.com.

Leidos ( LDOS ) lifted its quarterly payout by 7.5%, while LXP Industrial Trust (LXP) approved a 3.7% increase. Specialty chemical producer NewMarket (NEU) raised its dividend by 9.1%. Consulting firm CRA International (CRAI) stood out with a 16.3% hike, one of the strongest percentage gains this week. Vistra (VST) made a modest 0.4% lift, maintaining payout stability. Artesian Resources (ARTNA) raised its dividend by 2%, and Ingram Micro (INGM) declared a 5.3% increase.

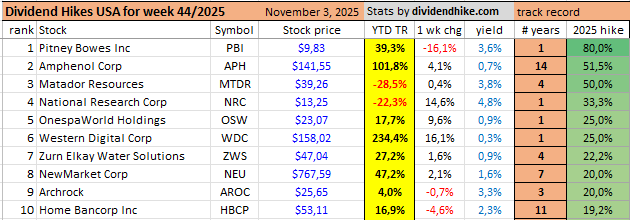

💥 Biggest Dividend Hikes – Recent Weeks

Several U.S. stocks posted notable dividend increases in recent weeks. Pitney Bowes (PBI) led the group with a strong payout boost, even as the stock dropped 16% last week but remains up 39% year to date. Amphenol (APH) also stood out — the electronics connector giant has now gained more than 100% in 2025 after another dividend raise.

Among energy and industrial names, Matador Resources (MTDR) and Archrock (AROC) delivered moderate yields near 3–4%, while Zurn Elkay Water Solutions (ZWS) and NewMarket (NEU) both continued steady shareholder returns.

Western Digital (WDC) surged after announcing a large 25% dividend hike, bringing its year-to-date total return above 230%. In the consumer and healthcare space, National Research (NRC) and OnespaWorld (OSW) both lifted payouts sharply, each posting double-digit share price gains over the past week.

Regional lender Home Bancorp (HBCP) and mid-cap Atlantic Union Bankshares rounded out recent financial-sector increases, with yields between 2% and 3%.

Overall, the latest group of dividend hikers spans multiple industries — from technology and manufacturing to energy and banking — showing continued strength in corporate payout growth heading into the final weeks of 2025.

Voya Financial (VOYA) increased its dividend by 4.4%, continuing its multi-year streak. Western Digital (WDC) announced a 25% hike — a notable move as the company resumes stronger shareholder returns. Rockwell Automation (ROK) lifted its dividend by 5.3%, and among REITs, Kimco Realty (KIM) and Kite Realty Group (KRG) each raised payouts by 7.4%.

Atlantic Union Bankshares (AUB) announced an 8.8% increase, Stepan (SCL) raised by 2.6%, and Pitney Bowes (PBI) closed the week with a 12.5% hike.

Together, these announcements highlight a steady end-of-year pattern of dividend growth across the U.S. market, led by familiar names such as Exxon Mobil, AbbVie, and Simon Property Group.

Source: www.dividendtrackrecords.com.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.