Volution Group: the small-cap dividend gem climbing to record highs

The UK ventilation leader delivers consistent double-digit growth, strong cash generation and rising shareholder returns.

Shares of Volution Group (LSE: FAN) jumped as much as 9% to a record high of 707p today, extending a strong year for the UK-based ventilation specialist.

Key Points in this article

Shares hit record 707p, up 22% year to date.

FY 2025 revenue +21% to £419M; adjusted operating profit +19.7%.

EBIT margin above 20%; strong balance sheet with minimal net debt.

Dividend up 20%, fourth consecutive year of double-digit growth.

Market cap £1.35B; P/E ~20; analyst sentiment remains positive.

The move follows another set of robust annual results and ongoing confidence in the company’s compounding growth strategy.

Business overview

Volution Group plc designs and manufactures energy-efficient ventilation and indoor air quality solutions for residential and commercial buildings. Its operations span the UK, continental Europe, and Australasia, with well-known brands including Vent-Axia, Manrose, Diffusion, PAX, inVENTer, Ventilair, and ClimaRad.

Fundamentals and performance

In FY 2025, Volution delivered a 21% increase in revenue to £419 million, with adjusted operating profit up 19.7% year on year to £93.4 million. The company continues to maintain a strong balance sheet with minimal net debt, providing ample flexibility for reinvestment and acquisitions.

Management expects double-digit growth again in FY 2026, supported by regulatory tailwinds in energy efficiency and healthy buildings, as well as continued integration of recent bolt-on acquisitions.

Volution’s EBIT margin remains above 20%, reflecting disciplined execution and operational efficiency.

Dividend and valuation

The company follows a progressive dividend policy, and the dividend is set to rise by 20% this year, marking the fourth consecutive year of double-digit growth. The current dividend yield is about 1.5%, and management aims to grow distributions annually while maintaining healthy earnings cover.

Volution just hiked its FY dividend by 20% to 10.8 pence per share, coming after a 12.8% dividend hike in 2024.

Despite reaching new highs, Volution’s market capitalisation of around £1.35 billion and forward P/E ratio of roughly 20 suggest a valuation that remains moderate for a company with such consistent and profitable growth dynamics.

Strategy and outlook

Volution’s growth strategy rests on three pillars — organic expansion, value-adding acquisitions, and operational excellence. Long-term demand for ventilation solutions is supported by decarbonisation goals, stricter energy-efficiency standards, and heightened awareness of indoor air quality.

The company continues to benefit from these structural trends, combining innovation with disciplined capital allocation to drive sustained shareholder value. We would not be surprised if Volution becomes one of the European Dividend Heroes down the road.

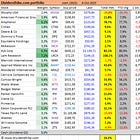

Analyst sentiment remains upbeat: two “Strong Buy,” two “Buy,” and three “Hold” ratings reflect confidence in the group’s prospects. The shares are now up 22% year to date.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.