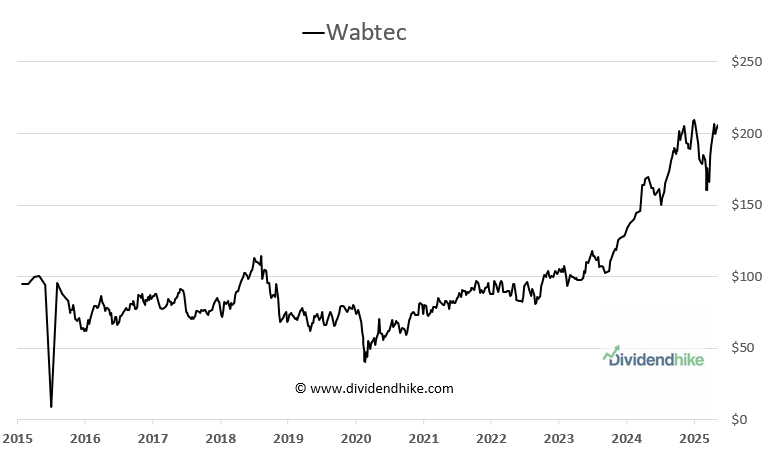

Wabtec: Rail technology leader with strong dividend growth

EPS growing double digits, EBIT margin near 20%, analysts firmly positive — and the stock is near all-time highs

We recently added Wabtec Corporation (WAB) to the Dividend Hike Portfolio. The reason for this, apart from valuation and growth prospects, is the dividend.

Little people know that Wabtec is aggresively raising its dividend for years now, combined with annual buybacks. We like this stock and we are not surprised that its trading near its all time high currently.

💰 For Investors: Wabtec Valuation, EPS Growth & Dividend

Wabtec’s recent financial performance and guidance paint a bullish picture for growth-focused and income-seeking investors alike.

Key Investor Metrics:

FY 2024 revenue: $10.4 billion (+7.3%)

Expected 2025 revenue growth: ≥ 5%

EPS growth: Double-digit increases for multiple years; +24% expected in 2025

Price-to-Earnings ratio (P/E): ~24x based on 2025 EPS forecast

EBIT margin: Approximately 20% — high for the industrial sector

Dividend: 25% hike in 2025 — included in our Dividend Portfolio

The average dividend hike in the last four years is 20% (annually!)

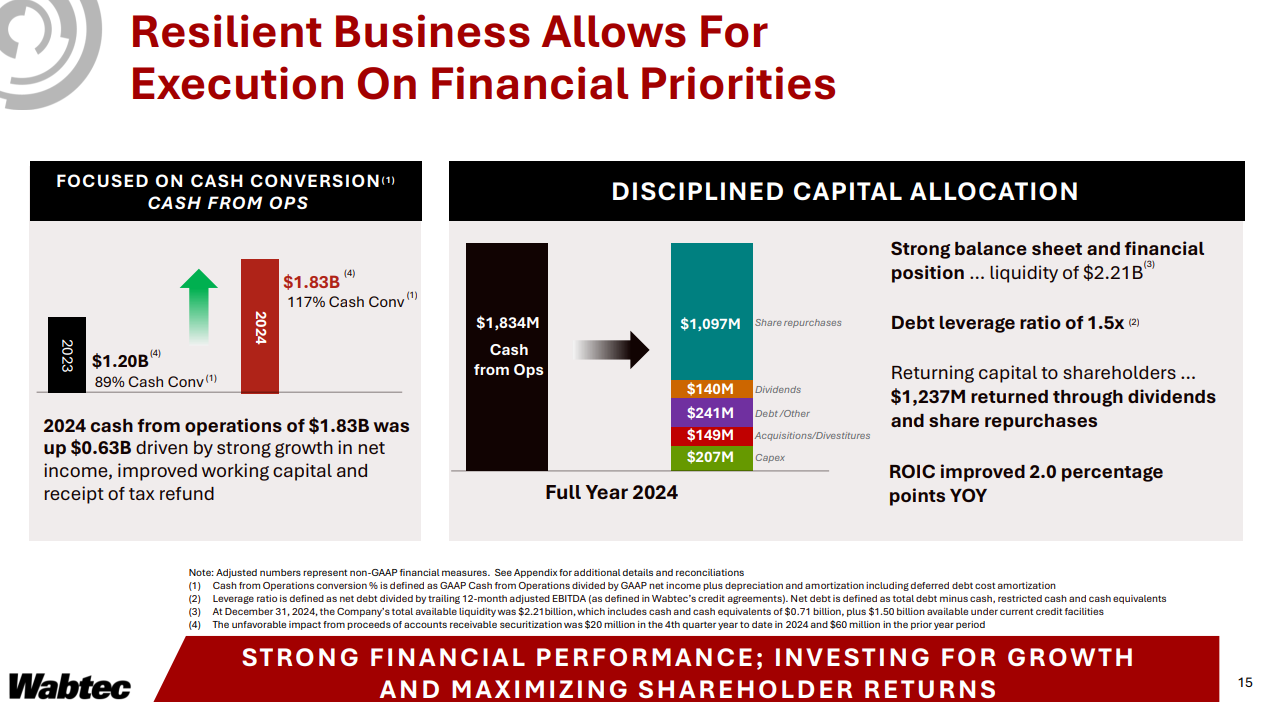

Wabtec has a low yield of 0.6% but only pays $171 million in dividend annually versus a free cash flow estimate of $1.4 billion in 2025.

Buybacks: Wabtec prefers buybacks over dividends with a $1 billion repurchase and $1.2 billion in total shareholder return in 2024.

Purchase price: Acquired at $189.70 on May 7; current price: $203.86

Analyst sentiment:

3× Strong Buy

4× Buy

6× Hold

0 Sell ratings

Westinghouse Air Brake Technologies Corporation, better known as Wabtec, is not just a pioneer in rail technology — it's also becoming an increasingly compelling name for long-term investors. With over 150 years of innovation behind it, the company today is a global force in freight and transit systems, and its performance in recent years shows how historical legacy can translate into modern financial momentum.

In the 2024 fiscal year, Wabtec delivered $10.4 billion in revenue, a 7.3% increase from the year before. The company expects to continue this upward trend, forecasting at least 5% revenue growth in 2025. Even more impressive is the sustained earnings power: Wabtec has grown earnings per share at double-digit rates for several consecutive years, and for 2025, management anticipates a robust 24% increase in EPS.

That growth trajectory places the current forward price-to-earnings ratio at around 24 — a valuation that may appear rich by traditional industrial standards, but one that aligns with the company’s consistent margin profile and expanding market reach. Wabtec operates with an EBIT margin close to 20%, underlining its efficiency and pricing power in a capital-intensive sector.

Wabtec Dividend & Buybacks

Importantly for income-focused investors, Wabtec also pays a growing dividend. While not the highest yield in the sector, its consistent payouts and upward earnings revisions make it a stable contributor in a long-term dividend portfolio. In fact, the stock was added to our Dividend Portfolio on May 7, at a price of $189.70.

Since then, it has continued to climb, recently reaching $203.86 — not far off its all-time high. The best part: Wabtec only pays $171 million in dividends with a free cash flow of $1.6 billion in 2025 and an estimated FCF of $1.4 billion for 2025. This means future (strong) dividend growth is very likely.

Wabtec announced a 25% dividend hike just this year, marking the fourth consecutive year of double digit increases. In fact, the dividend was hiked by an average of 20.2% in the last 4 years. What little people know is that Wabtec also did big dividend hikes from 2011 trough 2017 with an average annual increase of 65% (!). So every year, a 65% hike for 7 straight year.

Wabtec also buys back its own stock with 2.6% of its shares retired in 2024 and annual buybacks of 1.2% to 2.8% every year in the past four years. We expect this trend to continue in the coming years.

Analyst sentiment reinforces the positive outlook. Across the board, coverage is optimistic: three firms rate the stock a strong buy, four give it a buy rating, and the remaining six recommend holding. Notably, there are currently no sell ratings.

With a strong balance of growth, operational excellence, and capital returns, Wabtec is positioning itself not just as a rail innovator — but as a high-quality compounder for the years to come.

Are Wabtec shares a buy for you? If you value growing dividends and an attractive yield at a reasonable valuation, they just might be. Share your thoughts in the comments below! Thank you.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.