📉 Xerox: A 90% Dividend Cut and the Cost of Ignoring Red Flags

Xerox is a cautionary tale—one that dividend investors should study carefully

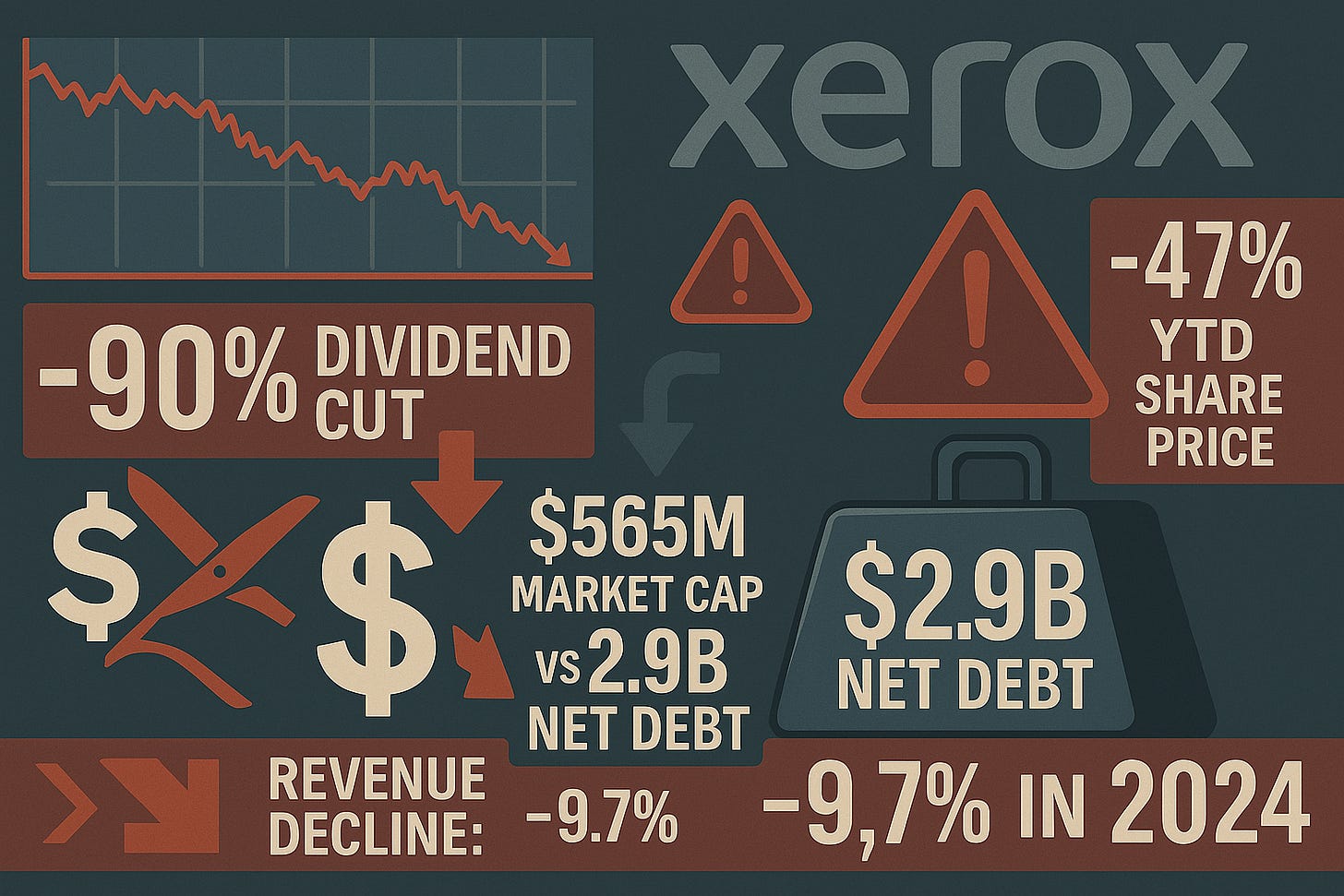

Dividend investors often search for high yields—but Xerox is a painful reminder that yield alone is never enough. In 2025, Xerox Holdings XRX 0.00%↑ cut its dividend twice, slashing it by a total of 90%. With a shrinking revenue base, mounting debt, and a decade-long stock decline of over 90%, the company now stands as a textbook example of what happens when financial fundamentals erode while shareholder payouts are maintained artificially. In this post, we break down the timeline of Xerox’s dividend collapse, what led to it, and what long-term income investors should take away from this high-yield trap.

Once a giant in office printing and document solutions, Xerox Holdings Corporation (XRX) has seen its core business decline, shareholder value collapse, and capital allocation strategy backfire. In 2025, the company delivered what may be the final blow to its income-focused investors.

🔻 A Brutal Dividend Collapse

This year, Xerox cut its dividend not once but twice:

On February 20, the payout dropped from $0.25 to $0.125 per share.

Then on May 22, it fell again to just $0.025 per share—a 90% decline year-to-date.

The annual dividend now stands at $0.10, yielding about 2.2% at a share price of $4.49 (or just 2.0% at Thursday’s closing price, the stock dropped another 12% last Friday).

CFO Mirlanda Gecaj framed the cut as a strategic move:

“We believe reducing our dividend creates greater financial flexibility to deploy cash in the most accretive manner,”

—as Xerox prepares for its acquisition of Lexmark.

But to investors, it looks more like financial distress.

🧾 Debt-Laden and Shrinking

Consider these balance sheet red flags:

Net debt at the end of 2024: $2.876 billion

Current market cap: just $565 million (!)

That means net debt is more than 5× the company’s market value, a striking sign of imbalance and risk.

Meanwhile, revenue trends have turned sharply negative:

2021–2022: stagnant growth

2023: –3.1%

2024: –9.7%

In other words: declining top line, rising debt, collapsing dividend. It’s a perfect storm.

📉 A Decade of Decline

The stock has now lost over 90% of its value in the past 10 years, including a 47% drop in 2025 alone. Xerox had already cut its dividend once in 2017 (–19.4%), then held it flat at $0.25 per share—an ominous plateau.

Even worse: Xerox spent aggressively on share buybacks until 2023, burning through capital that might have been used to reduce debt or preserve the dividend. These buybacks did nothing to halt the company’s slide.

🧠 The Dividend Investor's Lesson

A flat dividend is a warning sign, not a virtue.

Xerox teaches us several painful but critical lessons:

Watch for dividend growth—flat payouts signal fragility

Buybacks are useless in a declining business

Balance sheet and revenue health matter just as much as yield

Too many ignored the signs. Now the dividend is gone, the stock has cratered, and the company is buried in debt with a shrinking customer base.

Never chase yield without understanding what’s behind it. Xerox was a trap hidden in plain sight.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.