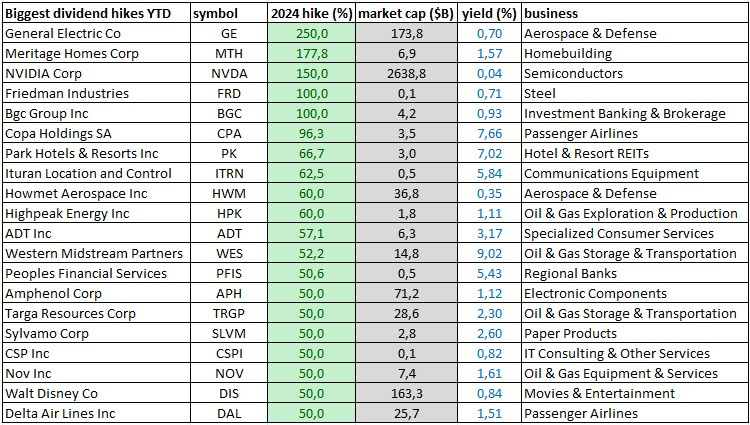

20 stocks with a 50%+ dividend hike in 2024

GE and NVDA announce biggest dividend hikes

In 2024, a notable group of companies have announced substantial dividend increases, reflecting their growth and profitability. Here's a list of 20 stocks that have raised their dividends by 50% or more this year:

Hi there! Before we continue please read this:

This is a free post (for 5 days) from dividendhike.com; if you did not yet subscribe (free or paid) you may have missed these must read articles:

Focus stock #4: A Dividend Powerhouse on the Rise (July 31)

The superstar Dividend Aristocrats (July 27)

Now lets move on to the article with the biggest dividend hikes so far in the United States this year.

TOP-20 DIVIDEND HIKES

General Electric Co (GE): Raised dividend by 250.0%; specializes in Aerospace & Defense with a market cap of $173.8 billion and a yield of 0.70%.

Meritage Homes Corp (MTH): Increased dividend by 177.8%; operates in Homebuilding with a market cap of $6.9 billion and a yield of 1.57%.

NVIDIA Corp (NVDA): Boosted dividend by 150.0%; a leader in Semiconductors with a market cap of $2,638.8 billion and a yield of 0.04%.

Friedman Industries (FRD): Expanded dividend by 100.0%; engages in Steel production with a market cap of $0.1 billion and a yield of 0.71%.

Bgc Group Inc (BGC): Announced a 100.0% dividend increase; involved in Investment Banking & Brokerage with a market cap of $4.2 billion and a yield of 0.93%.

Copa Holdings SA (CPA): Elevated dividend by 96.3%; operates in Passenger Airlines with a market cap of $3.5 billion and a yield of 7.66%.

Park Hotels & Resorts Inc (PK): Increased dividend by 66.7%; a Hotel & Resort REIT with a market cap of $3.0 billion and a yield of 7.02%.

Ituran Location and Control (ITRN): Raised dividend by 62.5%; provides Communications Equipment with a market cap of $0.5 billion and a yield of 5.84%.

Howmet Aerospace Inc (HWM): Enhanced dividend by 60.0%; involved in Aerospace & Defense with a market cap of $36.8 billion and a yield of 0.35%.

Highpeak Energy Inc (HPK): Increased dividend by 60.0%; operates in Oil & Gas Exploration & Production with a market cap of $1.8 billion and a yield of 1.11%.

ADT Inc (ADT): Raised dividend by 57.1%; specializes in Specialized Consumer Services with a market cap of $6.3 billion and a yield of 3.17%.

Western Midstream Partners (WES): Boosted dividend by 52.2%; involved in Oil & Gas Storage & Transportation with a market cap of $14.8 billion and a yield of 9.02%.

Peoples Financial Services (PFIS): Announced a 50.6% dividend increase; operates as a Regional Bank with a market cap of $0.5 billion and a yield of 5.43%.

Amphenol Corp (APH): Increased dividend by 50.0%; provides Electronic Components with a market cap of $71.2 billion and a yield of 1.12%.

Targa Resources Corp (TRGP): Raised dividend by 50.0%; involved in Oil & Gas Storage & Transportation with a market cap of $28.6 billion and a yield of 2.30%.

Sylvamo Corp (SLVM): Enhanced dividend by 50.0%; specializes in Paper Products with a market cap of $2.8 billion and a yield of 2.60%.

CSP Inc (CSPI): Boosted dividend by 50.0%; operates in IT Consulting & Other Services with a market cap of $0.1 billion and a yield of 0.82%.

Nov Inc (NOV): Raised dividend by 50.0%; engages in Oil & Gas Equipment & Services with a market cap of $7.4 billion and a yield of 1.61%.

Walt Disney Co (DIS): Increased dividend by 50.0%; a major player in Movies & Entertainment with a market cap of $163.3 billion and a yield of 0.84%.

Delta Air Lines Inc (DAL): Enhanced dividend by 50.0%; operates in Passenger Airlines with a market cap of $25.7 billion and a yield of 1.51%.

These significant dividend hikes highlight diverse sectors from technology and aerospace to airlines and homebuilding, reflecting a broad range of industry performance and financial stability. The video below was published earlier by our partner DividendFreak on Youtube, highlighting the 10 biggest increases including Cal-Maine Foods (CALM).

We left out Cal-Maine Foods (CALM), the egg producer leading all companies this year with a 12.733.3% dividend hike. We do this because CALM pays variable dividends based on earnings in each quarter. This results in big changes throughout the year with both cuts and hikes from quarter to quarter. Check out the up-to-date biggest YTD hikes on our special dividend statistics page.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.