Castellum AB: Dividend Returns in 2025 After a Painful Reset

A former Dividend Aristocrat rebuilding after the 2023 cut

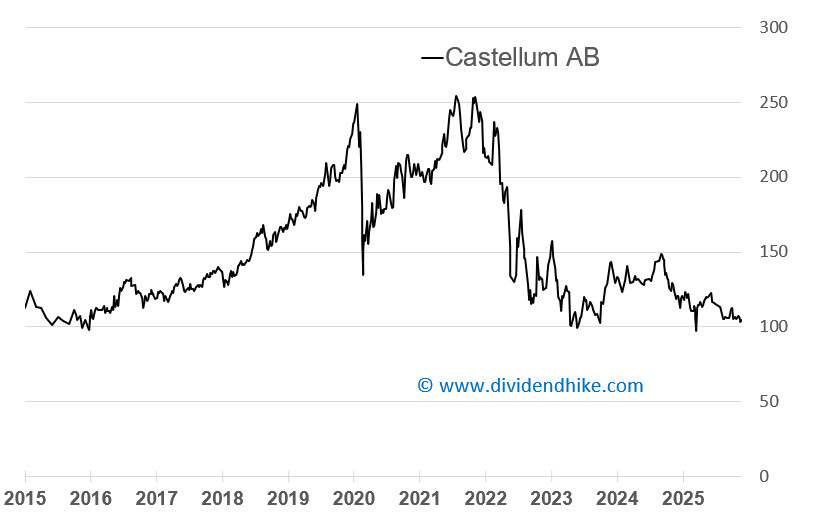

After being forced to suspend its dividend in 2023, Castellum AB has resumed shareholder payouts — but at a level far below its former peak. Once considered one of Europe’s rare dividend growth champions, the Swedish property company is now trying to rebuild credibility after several difficult years for both the share price and the dividend.

Key Points in this article

Dividend reinstated in 2025 after a two-year suspension

Current payout remains well below pre-2023 levels

Share price performance has been weak for several years

Analyst opinions remain sharply divided

One of the biggest disappointments in dividend investing in recent years came from Castellum AB, a former Dividend Aristocrat — a rare status in Europe — that suddenly cancelled its dividend in 2023. At that point, the dividend had increased for more than 20 consecutive years, with only one additional year needed to officially achieve Dividend Aristocrat status. That milestone was never reached.

Castellum had to cancel its dividend due to a difficult property market, marked by rising vacancy rates, significant write-downs in property values, higher operating costs (including energy), and increased financing expenses. Preserving cash and strengthening the balance sheet became necessary amid a challenging economic environment.

After two years without any dividend, Castellum has reinstated a payout this year, although at a level far below the former dividend, which used to be paid quarterly. In 2022, the company distributed a total of SEK 7.60, paid as four quarterly installments of SEK 1.90.

This year’s dividend amounts to just SEK 2.48, a sharp reduction compared with the pre-cut level. Castellum can therefore no longer be considered a true dividend stock. At a share price of around SEK 105, the dividend yield stands at only 2.4%, which is modest, especially for a European real estate company.

The stock has performed poorly for several years. As of 24 December 2025, Castellum is down 13% year-to-date, following a 16% decline in the previous year. Over the past ten years, excluding dividends, the share price has delivered virtually no net return. In 2022, the stock collapsed by 48%, marking the beginning of both the share price decline and the dividend suspension.

UK insurer with 8.4% yield and 5% annual growth

Sometimes we come across stocks that make us pause and think: okay, this is interesting. Legal & General (L&G) is one of those names.

Castellum currently has a market capitalization of approximately USD 5.6 billion. Analyst sentiment is highly divided, which is not surprising given the share price performance and the reduced dividend. At present, the stock is rated 4 buys, 6 holds, and 4 sells.

It is worth noting that Castellum is a Swedish commercial real estate company focused on owning, managing, and developing office, logistics, and public-sector properties, primarily in the Nordic region. According to its own website, the company emphasizes long-term property ownership, sustainability, and urban development in growth-oriented cities.

Stats & fundamentals for Castellum AB

Dividend 2025: SEK 2.48 (after two years without dividend)

Dividend 2022: SEK 7.60 (4× SEK 1.90, quarterly)

Dividend yield: ~2.4% at a share price of SEK 105

Share price performance: −13% YTD (as of 24 Dec 2025); −16% in 2024

2022 share price decline: −48%

Market capitalization: approximately USD 5.6 billion

Analyst ratings: 4 Buy, 6 Hold, 4 Sell

We are aware that there are other real estate companies in Europe — and particularly in Sweden — with stronger dividend histories and more consistent dividend growth. We will explore some of those in more detail on DividendHike.com at a later stage. We also readily acknowledge that we are not experts in real estate investing, a sector that requires a different analytical approach compared with more traditional equities. For that reason, we tend to be cautious with property stocks, as well as with banks and other financial institutions that are more complex to assess.

More information is available on the company’s official website: https://www.castellum.com/

Would you consider buying Castellum at current levels? And which real estate stocks are your favorites right now? Let us know in the comments.

At DividendHike.com, we focus on tracking dividend growth trends and highlighting companies with consistent payout policies across global markets. By combining dividend data with clear, factual context, we aim to surface income-focused opportunities that may deserve closer attention. Stay tuned as we continue to follow dividend hikes, long-term payout trends, and the companies behind them.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.