Dividend Hike portfolio update August 2025

Four double digit dividend hikes and a 9.6% return YTD

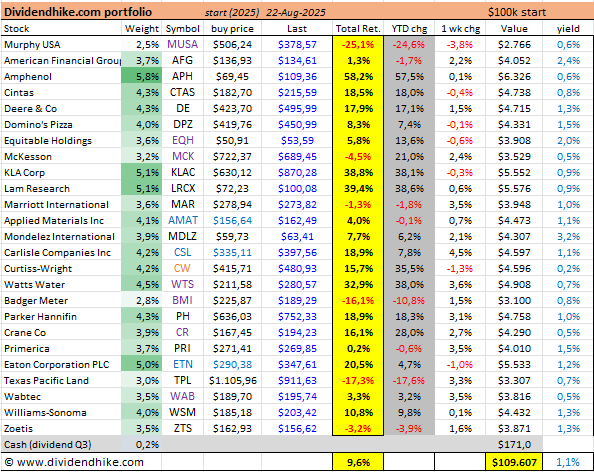

The Dividend Hike Portfolio continues to show a mix of performance across its holdings. Year-to-date, the biggest winners include Amphenol APH 0.00%↑ , up 57.5%, KLA Corp KLAC 0.00%↑ at +38.1%, Lam Research LRCX 0.00%↑ +38.6%, and Watts Water WTS 0.00%↑ +38.0%. Other notable contributors are Curtiss-Wright CW 0.00%↑ , up 35.5%, and McKesson MCK 0.00%↑ , +21.0%.

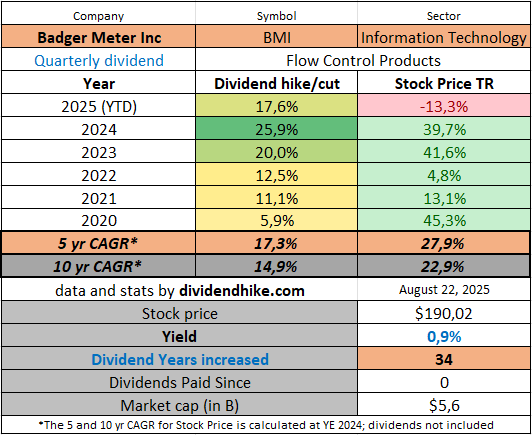

On the flip side, the largest laggards are Murphy USA MUSA 0.00%↑ , down 24.6%, Texas Pacific Land TPL 0.00%↑ -17.6%, and Badger Meter BMI 0.00%↑ -10.8%.

The portfolio has also benefited from strong dividend increases this quarter, with Carlisle CSL 0.00%↑ , McKesson MCK 0.00%↑ , American Financial Group AFG 0.00%↑ , and Badger Meter BMI 0.00%↑ all raising their dividends by 10% or more. So far in Q3, the portfolio has received $171 in dividends, which will be reinvested at the end of the quarter.

The current average portfolio yield stands at 1.1%, reflecting the blend of higher-growth and dividend-raising positions. Overall, the portfolio shows a balance of capital appreciation from technology and industrial holdings, alongside steady income growth from dividend hikes.

We are very pleased with this result despite the disappointing performance of the oil-related holdings. The average Dividend Aristocrat has performed somewhat worse in 2025, with a gain of +6.9%.

We continue to constantly look for ways to improve the portfolio, but for now we are satisfied and confident in the future (dividend) growth of the 25 stocks.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.