Dividend hikes and cuts for Week 21, 2025

Medtronic’s 48-Year Dividend Streak and Xerox’s Massive Cut

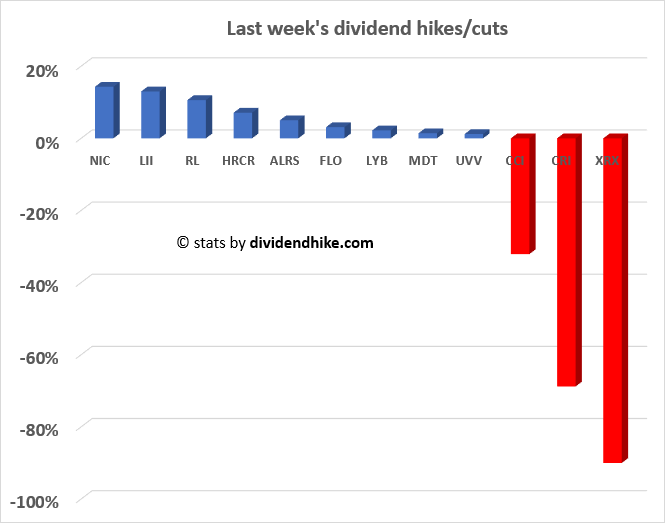

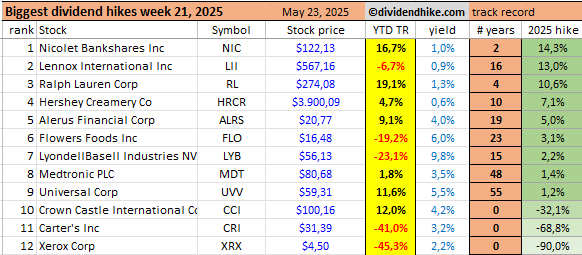

For week 21 of 2025, the dividend landscape delivered some of the most impactful moves investors must not ignore. Xerox Corp XRX 0.00%↑ , a major force in document technology, stunned the market by slashing its dividend for the second time this year—bringing total cuts to a jaw-dropping 90% in 2025.

This drastic move signals serious operational challenges and sends a clear warning to income-focused investors.

On the other side of the spectrum, Nicolet Bankshares Inc NIC 0.00%↑ , a robust regional bank with strong fundamentals, led the pack with a commanding 14.3% dividend increase, a clear demonstration of its confidence and solid financial health.

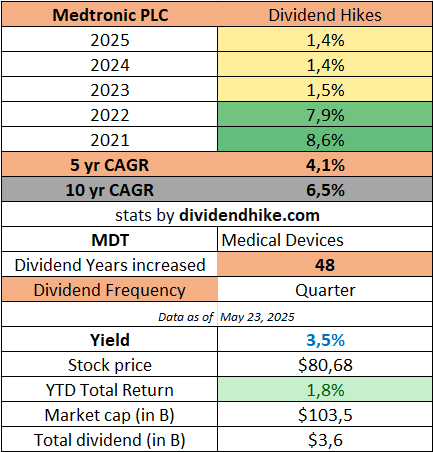

Adding to the roster of dividend legends, Medtronic PLC MDT 0.00%↑ , a global leader in medical technology, celebrated its 48th consecutive year of dividend increases. However, investors should note that despite this impressive streak, Medtronic’s dividend growth remains subdued, reflecting a cautious capital deployment strategy in a challenging environment.

Meanwhile, Universal Corp UVV 0.00%↑ , a powerhouse in tobacco leaf processing, extended its remarkable streak to 55 consecutive years of dividend increases, a testament to its unwavering commitment to rewarding shareholders and enduring resilience.

Lennox International Inc LII 0.00%↑ , a dominant HVAC equipment manufacturer, stands out as the undisputed champion of dividend growth, boasting the strongest average increases over recent years. Even with a modest yield below 1%, Lennox’s strategy clearly focuses on maximizing long-term shareholder value rather than short-term payouts.

Stock performance adds further context. Ralph Lauren Corp RL 0.00%↑ , a global apparel icon, delivered an impressive 19.1% year-to-date total return, showcasing robust momentum. Meanwhile, Xerox experienced a dramatic collapse, with stock price plummeting over 45%, illustrating the stark risks some companies face.

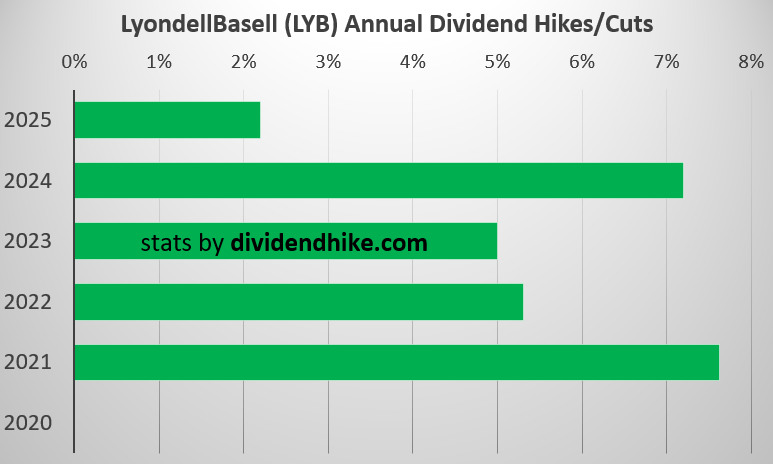

Dividend yields show wide variation. Chemical giant LyondellBasell Industries NV LYB 0.00%↑ offers a highly attractive near-10% yield, making it a compelling option for income seekers willing to accept additional risk.

In summary, this week’s dividend hikes and cuts are not just numbers—they are clear signals of shifting corporate fortunes and strategic recalibrations. For income-focused investors, understanding these moves—and the powerful stories behind them—is absolutely essential to navigating today’s volatile and uncertain markets.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.