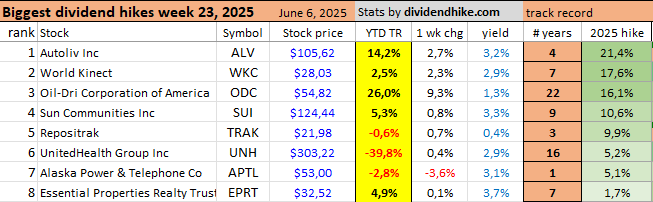

Dividends in the Wild: Pet Care, RV Parks, and a SaaS Surprise in Week 23 Hikes

8 dividend increases this week — including 4 double-digit hikes, a disappointing move from UnitedHealth, and three underrated stocks worth knowing.

🟠 Key Points

8 U.S. companies raised their dividends this week, including 4 double-digit hikes — signaling strong underlying confidence from management.

A fast-growing SaaS newcomer announced its 3rd consecutive dividend increase — coming in just shy of double digits. (Full name and analysis for subscribers only.)

Two niche plays stood out: one in pet care, the other a REIT focused on RV parks and campgrounds — both offering income with a growth twist.

🔔 Dividend Watch – Week 23 Recap (June 2–6, 2025)

In an otherwise quiet week, 8 U.S.-listed companies announced dividend increases — and while the volume may be modest, the quality of some names more than makes up for it.

💥 Four of the hikes were double-digit increases — always a sign of strength.

Two of them immediately caught our attention: strong balance sheets, sustained free cash flow, and growing pricing power in their niches.

But the real surprise?

A newcomer from the SaaS world delivering an almost-double-digit hike — a bold move for a company still in growth mode. We’re excited about its trajectory, and we’re breaking down the full story exclusively for our paying readers.

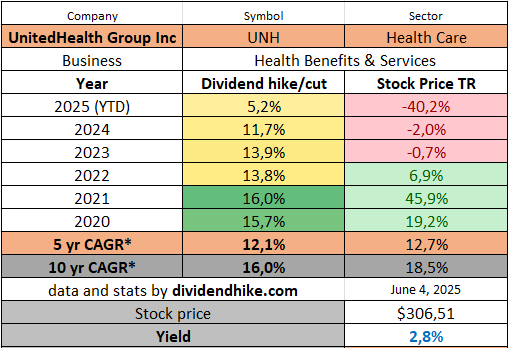

😬 UNH: Big Name, Small Hike

Among this week’s dividend raisers, UnitedHealth Group (UNH) stood out — but not in a good way. With a market cap of $275 billion, it’s by far the largest name on the list. But after years of delivering double-digit increases, this year’s 5.2% raise feels underwhelming.

Still, to be fair, this marks UNH’s 16th consecutive year of dividend growth — a testament to its resilience, if not its current enthusiasm for shareholders.

Below, we highlight all 8 dividend hikes — and zoom in on three hidden gems that are flying under the radar but may deserve a spot on your watchlist, including a two niche plays: one in pet care, the other a REIT focused on RV parks and campgrounds — both offering income with a growth twist. In fact: they hiked their dividend by double digits last week, and one of them is actually trading at an all time high.

(Hint: You've probably never heard of them — but you’ll wish you had.)

Below are all the dividend increases from the past week; we are particularly impressed by three stocks: Oil-Dri, Sun Communities, and ReposiTrak.

ReposiTrak TRAK 0.00%↑ is a company you probably never heard of. The good thing is that they are paying dividends since 2022 and hiked the dividend by 10% every single year. TRAK offers a unified platform that helps retailers and suppliers track products from source to shelf, ensuring fast and accurate recalls with clean data. It automates compliance by managing supplier documents and sharing real-time data across a vast network.

ReposiTrak has a forward P/E of 62, which is high but not unusual for a SaaS company with significant recurring revenue and a relatively small market cap of $400 million. The company generated $20 million in revenue in 2024 and is expected to continue growing at a double-digit rate in the coming years. It’s not a hyper-growth stock, but a stable, debt-free business showing consistent growth.

The system also reduces out-of-stocks and improves inventory performance with tools for forecasting, ordering, and margin tracking. In short, it supports supply chain safety, compliance, and efficiency—all within one cloud-based solution. For more on this company check repositrak.com.

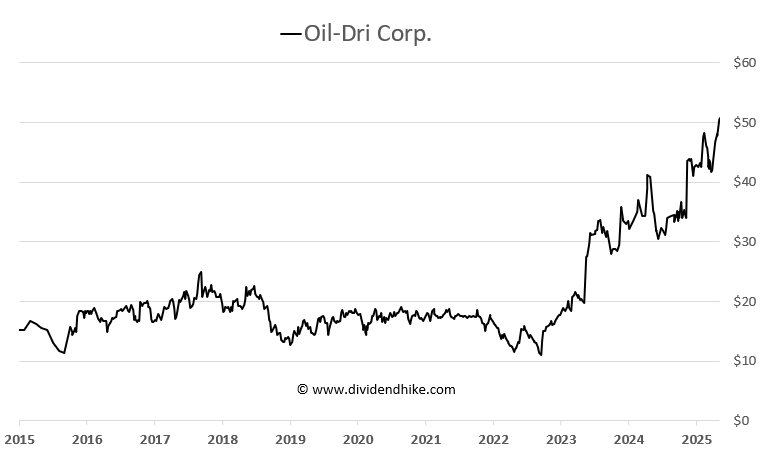

Oil-Dri Corporation ODC 0.00%↑ raised its quarterly dividend by 2.5 cents, marking 22 consecutive years of growth. ODC is a vertically integrated global producer of specialty sorbent minerals. The new dividend is $0.18 per Common share and $0.135 for Class B shares—up about 16%. Dividends are payable August 22, 2025, to shareholders on record as of August 8. For ODC this is the biggest dividend hike since 2006. The company, known for its cat litter and many other products including sports turf solutions is trading at a record high. We understand why.

Sun Communities SUI 0.00%↑ is a REIT focused on manufactured housing and RV communities. The company declared a Q2 2025 dividend of $1.04 per share, payable July 15 to shareholders on record as of June 30. This 10.6% dividend hike is the biggest since we track SUI. The company also paid a $4.00 special dividend this May.

Check out last week’s dividend hikes (week 22) right here.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Oil-Dri closed up 8% Yesterday! The stock is now up 35% YTD and trades at an all time high!