Farmer Mac: Powering Rural America Through Finance

Dividend Hero AGM has raised its payout 14 consecutive years

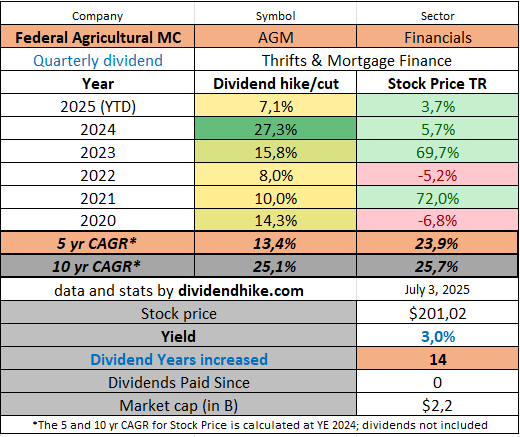

In this post we look at Dividend Hero Federal Agricultural Mortgage Corporation AGM 0.00%↑ also known as Farmer Mac. We look at the company’s dividend history, dividend growth track record and recent developments.

Key Points

AGM is a top-25 Dividend Hero in 2025

The dividend has been raised 14 consecutive years with a 5 year CAGR of 15%

2025 dividend growth is dissapointing with a 7.1% increase

Farmer Mac (Federal Agricultural Mortgage Corporation) is a federally chartered, stockholder-owned corporation that combines private capital with public sponsorship to fulfill a public mission: increasing the flow of credit to rural America. Established under the Agricultural Credit Act of 1987, it functions as a government-sponsored enterprise (GSE) focused on agricultural and rural infrastructure finance.

Dividend Hike Portfolio Hits All-Time High with +9.7% Return in 2025

The Dividend Hike Portfolio was launched in 2025 and now, almost six months later, it has delivered a return of 9.7%. After a strong week, it reached an all-time high.

By operating a robust secondary market for rural loans, Farmer Mac helps unlock capital for local lenders—such as community banks, rural cooperatives, and ag lenders—so they can continue to serve farmers, agribusinesses, and infrastructure providers across the country.

What Farmer Mac Does

Farmer Mac provides liquidity and risk transfer solutions through the purchase, guarantee, and securitization of eligible loans. Its business model is structured around several key market segments, each targeting a vital part of the rural economy:

Farm & Ranch

This foundational segment includes USDA-guaranteed securities, direct Farm & Ranch loans, and AgVantage® securities. It supports traditional agricultural real estate lending for family farms and smaller operations.Corporate AgFinance

This segment targets larger, more complex farming operations, as well as agribusinesses involved in food and fiber processing and supply chain infrastructure. Farmer Mac provides both direct loans and AgVantage structures to serve these institutions.Power & Utilities

Farmer Mac finances rural electric cooperatives—both generation and transmission—as well as distribution networks. These loans and AgVantage securities help ensure reliable energy access in underserved regions.Broadband Infrastructure & Renewable Energy

In response to national rural development goals, Farmer Mac has expanded to support the buildout of broadband internet and renewable energy systems in non-urban areas. These custom solutions are essential for modernizing rural infrastructure.Funding & Investments

This segment focuses on balance sheet management and long-term capital sustainability, including investment activities that support Farmer Mac’s mission while maintaining financial strength.

Liquidity Tools and Financing Solutions

Farmer Mac’s offerings help lenders manage capital, reduce risk, and extend credit:

Loan Purchases: Acquisition of long-term, fixed-rate agricultural loans at or after origination.

Credit Protection Products: Standby purchase commitments and guarantees that mitigate credit risk.

AgVantage®: A unique wholesale funding facility secured by eligible loan collateral.

Agricultural Mortgage-Backed Securities (AMBS): Securitizations with Farmer Mac’s guarantee to ensure liquidity and credit support.

Customized Structures: Financing solutions tailored to energy, broadband, and agribusiness lenders.

Together, these tools form a secondary market infrastructure that sustains long-term lending throughout rural America.

Growth Outlook

Farmer Mac’s insights platform, The Feed, offers regular economic commentary on rural credit markets. After a challenging period of margin pressure and declining farm income, the outlook for 2025 suggests gradual stabilization—particularly in the livestock sector and regions benefiting from government support.

While ag lenders saw profitability decline in 2024 due to softer commodity prices and global export saturation, Farmer Mac’s research points to measured optimism going forward.

In 2024 the company’s revenue grew by 3.85% to $363.7 million with $353.87 million of that coming from net interest rate income. Analysts expect 7.7% revenue growth to $391.65 million in 2025 with a net interest income of $371 million (+5.1% YOY).

Earnings per share for AGM is expected to rise from $15.64 in 2024 to $17.42 in 2025. This translates into a current estimated p/e of 11.5 at a stock price of $201.

Market Role and Peers

Farmer Mac operates alongside—but independently from—other institutions such as the USDA’s loan programs and the Farm Credit System. While those entities also serve rural borrowers, Farmer Mac’s role is unique: it provides liquidity, capital relief, and credit protection by serving as a secondary market buyer and guarantor.

Oversight is provided by the Office of Secondary Market Oversight, a division of the Farm Credit Administration, which ensures regulatory compliance and mission alignment.

Shareholder Returns

Farmer Mac also maintains a strong focus on delivering value to shareholders. The company currently pays a quarterly dividend of $1.50 per share on its common stock, typically in March, June, September, and December.

There is no active stock repurchase or dividend reinvestment program, reflecting a strategy focused on long-term capital strength and reliable income distribution.

AGM currently has a 3.0% dividend yield at a stock price of $201.02. The dividend was hiked by 7.1% in 2025, lagging the stronger dividend growth in the last couple of years. In 2024 AGM hiked by 27.3%, earning the company a spot in the 2025 Dividend Heroes Selection. If however they do not announce another dividend hike in 2025, which is very unlikely since they always did one hike every year, AGM will not be a Dividend Hero again in 2026.

The stock is holding up pretty nice in 2025 with a 2% gain, following a 3% gain in 2024 and a 69.7% gain in 2023.

Final Thoughts

Farmer Mac occupies a unique position at the intersection of finance, agriculture, and infrastructure. By blending public purpose with private capital, it helps ensure that rural communities across the U.S. have access to the credit they need to grow, modernize, and thrive.

Its focus on mission-aligned financing, coupled with a stable dividend and disciplined capital management, makes Farmer Mac a noteworthy name for income-focused investors seeking exposure to rural America’s long-term development.

However we are a bit dissapointed in the 2025 dividend hike. Currently 2 analysts are tracking AGM and one of them rates the stock a ‘buy’ and one a ‘hold’. We will keep track of the stock throughout the year, especially since it’s one of our top-25 Dividend Heroes for 2025.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.