Investment AB Latour: Long-Term Swedish Dividend Grower

An industrial holding with a progressive dividend policy and steady long-term growth

Investment AB Latour is a Swedish investment company based in Gothenburg, well known for its long record of dividend growth. For decades, Latour has steadily raised its annual dividend, supported by a balanced structure that combines wholly owned industrial operations with significant holdings in listed Nordic and European companies. This long-term approach has made Latour one of Sweden’s most respected investment groups among dividend-focused investors.

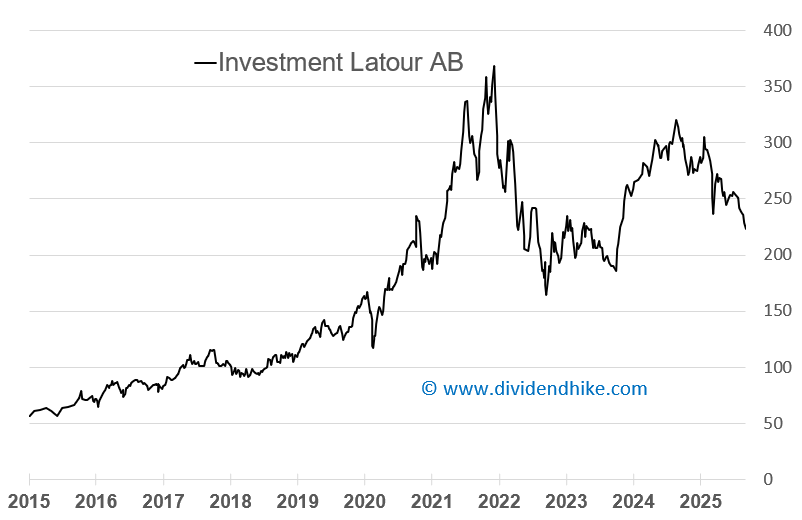

One of the largest investment holdings in Sweden — often seen as an alternative to Investor AB — Latour has a market capitalization of approximately USD 15.5 billion. The share price is down around 11 % this year, roughly in line with the performance of its main listed holdings. Latour pays its dividend once a year and has delivered an average annual dividend growth rate of over 10 % during the past decade.

Key Points

One of Sweden’s largest investment holdings, often compared to Investor AB.

Market cap ≈ USD 15.5 billion; share price −11 % year-to-date.

2025 dividend: SEK 4.60 (+12 %), fifth consecutive year of growth.

Ten-year average dividend growth above 10 % per year; current yield ~1.9 %.

Pays dividend once per year; NAV estimated at SEK 213 per share (vs price ~SEK 245).

Analysts’ views: 1 strong buy | 2 hold | 1 sell.

Revenue for 2024 was SEK 25.9 billion, and it is expected to grow to SEK 27.9 billion in 2025 (+7.8 %).

Net asset value (NAV) per share is estimated at SEK 213 with the current share price around SEK 245. Analyst opinions are mixed: one rates the stock a “strong buy,” two recommend “hold,” and one rates it a “sell.”

Company Overview

Investment AB Latour operates as both an industrial group and a long-term investment company. Its dual structure allows for stable cash flows from its industrial subsidiaries while benefiting from the growth of its listed holdings. The company’s industrial operations cover segments such as tools, ventilation and climate control, hydraulics, and industrial components. Subsidiaries are run independently within a decentralized management framework that encourages entrepreneurship and accountability.

The investment portfolio forms the second pillar of Latour’s structure. The company holds significant minority stakes in leading Nordic and European firms known for their strong brands and international expansion. These holdings generate recurring income through dividends while offering long-term value appreciation.

Investment Portfolio

Latour’s listed portfolio includes globally recognized names such as ASSA ABLOY AB, Securitas AB, HMS Networks AB, and Tomra Systems ASA. These holdings operate across diverse industries — from security and access systems to automation and recycling technologies.

Latour manages its investments with a long-term, active ownership approach, participating in governance through board representation. The company focuses on sustainable, compounding value rather than short-term market movements, mirroring its disciplined and progressive dividend philosophy.

History and Background

Founded in 1984, Investment AB Latour has evolved into one of Sweden’s leading investment companies. The group’s origins are linked to entrepreneur Gustaf Douglas, whose family remains a major shareholder with 75.4% of shares outstanding. Latour’s philosophy of patient, value-based ownership has shaped its culture and guided its strategy for more than four decades.

The company has grown through both organic expansion and strategic acquisitions, reflecting Sweden’s strong industrial heritage. Its consistent financial performance and long-term outlook have made it a cornerstone of the Swedish investment landscape.

A Swedish Leader in Tactical Communication

Our new Focus Stock from Sweden is a little-known Defense and Public Safety play that is perfectly positioned to benefit from the surging defense spending in Europe.

Market Position and Peers

In its industrial operations, Latour competes in sectors such as ventilation, tools, and automation through subsidiaries like Swegon and Hultafors Group, which operate globally.

In its investment activities, Latour’s closest peers are Investor AB, Industrivärden, and Lundbergsföretagen — all known for their similar model of long-term industrial ownership. Together, these companies form the backbone of Sweden’s family-influenced corporate ecosystem, emphasizing sustainability, control, and continuity.

Shareholding and Governance

Latour AB is listed on Nasdaq Stockholm under the ticker LATO B. The Douglas family remains the dominant shareholder, ensuring stability and alignment with the company’s long-term objectives. The board and executive team oversee both the industrial and investment divisions, maintaining a clear strategic balance between them.

Corporate Direction and Dividend Policy

Latour’s strategy centers on being a responsible, long-term owner that fosters sustainable growth. This principle is reflected in its dividend policy, which aims for steady, predictable increases backed by strong cash flow and conservative financial management.

In 2025, the dividend was increased by 12 % to SEK 4.60 per share, marking the fifth consecutive year of dividend growth. The current dividend yield stands at about 1.9 %. Although Latour has an outstanding dividend record, it did cut its dividend by 50 % during the COVID-19 pandemic — a rare interruption in an otherwise consistent track record.

With more than a decade of double-digit dividend growth and a diversified mix of industrial and listed assets, Investment AB Latour continues to represent one of Sweden’s strongest examples of consistent dividend progression and long-term value creation.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.