Extra! 🚨 Huge Day for the Dividend Hike Portfolio: +9.5% in One Day!

12 double digit gainers with Lam Research up 18% as biggest winner

Today’s market reaction to Trump’s announcement of a 90-day tariff pause sent shockwaves through Wall Street – and the Dividend Hike Portfolio was no exception. The portfolio surged by an incredible 9.5% in just one day – a gain that’s truly unprecedented.

With 12 stocks posting over 10% gains, this day was one for the books. The biggest winner? Lam Research LRCX 0.00%↑ , which skyrocketed by 18%.

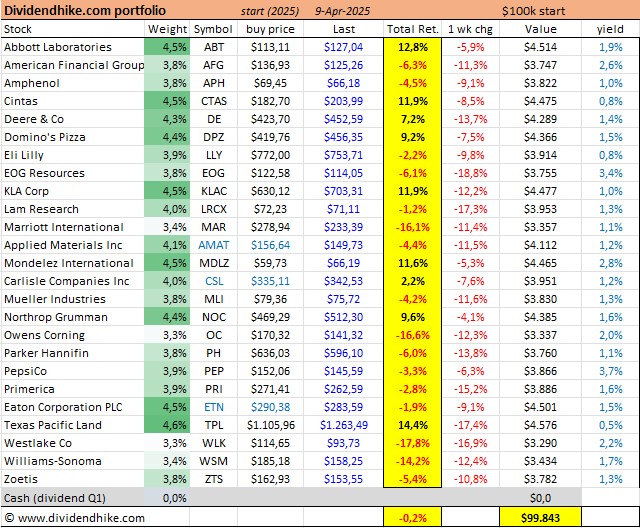

As of now, the 2025 year-to-date return stands at -0.2%. While still slightly negative, this performance is significantly outpacing U.S. market indices, which have struggled in comparison.

This massive one-day jump showcases the power of dividend-focused investing in times of market volatility. Despite the broader economic challenges, the Dividend Hike Portfolio continues to prove resilient and well-positioned to outperform. Stay tuned for more updates as we ride this wave of volatility!

Earlier today, we posted a new article highlighting five big losers that present a buying opportunity – and two of these Dividend Heroes are also part of the Dividend Hike Portfolio.

Now let’s dive into the full 25 stock dividend portfolio and check the biggest movers from Today!

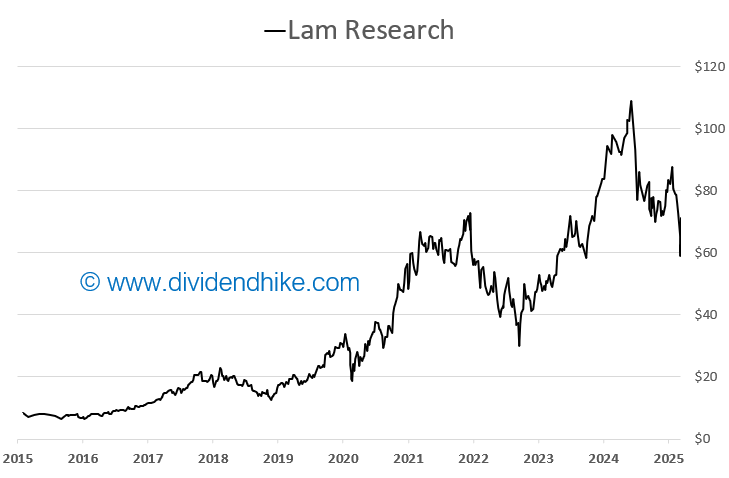

On April 9, 2025, several stocks saw impressive gains, with Lam Research Corp LRCX 0.00%↑ leading the charge with a remarkable 18.0% increase. Lam Research, a global leader in semiconductor equipment used in the production of integrated circuits, showed its strength in the tech sector as demand for chip manufacturing equipment remains robust.

Following closely behind, Applied Materials Inc AMAT 0.00%↑ surged by 16.1%. Applied Materials, a major player in semiconductor equipment manufacturing, has been benefiting from ongoing demand in the tech space, positioning it as a key growth stock in the market.

Other notable winners include KLA Corp KLAC 0.00%↑ , which jumped 17.3%. KLA, a leader in process control and yield management solutions for the semiconductor industry, continues to capitalize on the booming demand for advanced semiconductor technology.

The Daily Gains on April 9, 2025:

Lam Research Corp (LRCX) – +18.0%

KLA Corp (KLAC) – +17.3%

Applied Materials Inc (AMAT) – +16.1%

Texas Pacific Land Corp (TPL) – +13.1%

Williams-Sonoma Inc (WSM) – +13.7%

Parker-Hannifin Corp (PH) – +13.4%

Eaton Corporation PLC (ETN) – +12.8%

Westlake Corp (WLK) – +12.8%

Owens Corning (OC) – +11.9%

Mueller Industries Inc (MLI) – +10.5%

Marriott International Inc (MAR) – +10.5%

Amphenol Corp (APH) – +10.2%

Deere & Co (DE) – +9.6%

EOG Resources Inc (EOG) – +8.7%

Carlisle Companies Inc (CSL) – +8.0%

American Financial Group Inc (AFG) – +6.9%

Cintas Corp (CTAS) – +7.3%

Primerica Inc (PRI) – +7.4%

Zoetis Inc (ZTS) – +6.3%

Domino's Pizza Inc (DPZ) – +6.0%

PepsiCo Inc (PEP) – +3.8%

Eli Lilly and Co (LLY) – +3.8%

Mondelez International Inc (MDLZ) – +3.3%

Northrop Grumman Corp (NOC) – +4.1%

Abbott Laboratories (ABT) – +2.5%

Marriott International Inc MAR 0.00%↑ saw a 10.5% increase, reflecting a strong recovery in the hospitality industry. As a global leader in hotel and lodging services, Marriott is benefiting from the resurgence in global travel and tourism.

Owens Corning OC 0.00%↑ also had a standout day, rising 11.9%. A global leader in building materials, Owens Corning's growth reflects the strong demand in the construction sector, particularly for insulation and roofing products.

Our three new purchases rebounded strongly today: Carlisle is back in the green, while the previously significant losses for Applied Materials and Eaton have almost been completely recovered in one go.

Other significant gainers included Parker-Hannifin Corp PH 0.00%↑ with a 13.4% increase, Texas Pacific Land Corp TPL 0.00%↑ up by 13.1%, and Westlake Corp WLK 0.00%↑ , which gained 12.8%. These companies span industries from industrial manufacturing to natural resources, showing how diverse sectors are benefiting in the current market climate.

Additionally, Deere & Co DE 0.00%↑ , known for its agricultural and construction equipment, rose 9.6%, while Mueller Industries Inc MLI 0.00%↑ , a leading manufacturer of copper, brass, and aluminum products, climbed 10.5%.

These gains reflect the strength and diversity within the Dividend Hike Portfolio, with companies in tech, industrials, construction, and hospitality all showing strong upward momentum today. The overall market is responding to global economic shifts, and these companies are well-positioned to capitalize on emerging opportunities.

We also reinvested $430.85 in dividends received so far, with all the newly purchased shares benefiting directly from today’s significant stock gains!

For now, we remain satisfied with the portfolio composition and will not be making any changes. If you have any questions about the portfolio or a stock, please leave us a message by chat or email!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.