A little known Parker Hannifin peer from Sweden

Industrial company with robust dividend growth, substantial share buybacks, and active M&A strategy

Sweden is home to several globally competitive companies, each excelling in their respective industries. This week, we take a closer look at three outstanding Swedish dividend growth stocks—companies with strong competitive moats, an impressive dividend track record featuring double-digit annual increases, substantial share buybacks, and robust free cash flow.

Our first stock is a true peer to Parker Hannifin, having just announced another double-digit dividend hike for FY 2024. Beyond its strong dividend growth, this company is renowned for its aggressive share repurchase program, buying back 5% of its outstanding shares annually over the past several years.

In this Focus Stock series, we highlight three lesser-known dividend growth gems from Sweden. Today, we introduce #1—a leading industrial company with an $8 billion (SEK 88 billion) market cap, offering a product portfolio similar to Parker Hannifin (PH).

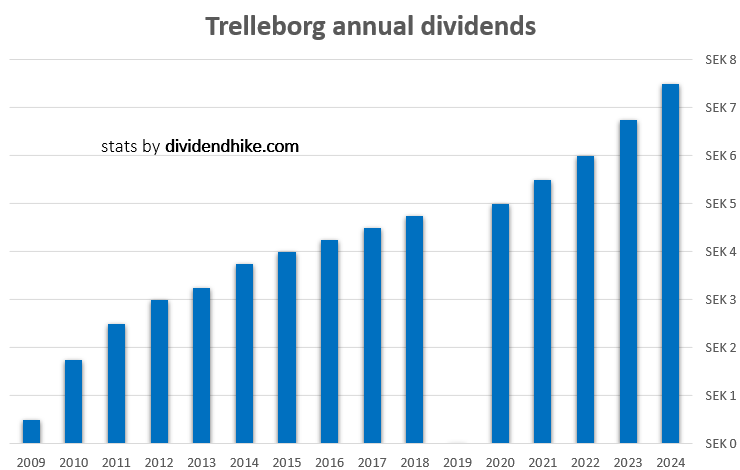

Our new Focus Stock produces aircraft seals, industrial fluid systems, anti-vibration mounts for automotive applications, and oil & gas pipeline protection solutions. It currently boasts a 1.8% dividend yield, with another double-digit dividend increase just announced for 2025. In fact, this company has raised its dividend 14 times in the last 16 years, solidifying its reputation as a consistent wealth creator for shareholders.

Our new Focus stock from Sweden is Trelleborg AB

History: Founded in 1905 in the Swedish town of Trelleborg, Trelleborg AB initially focused on rubber production. Over the decades, the company expanded its expertise into engineered polymer solutions, catering to a wide range of industries. It became a key supplier to sectors such as automotive, aerospace, marine, healthcare, and industrial manufacturing. Through acquisitions and innovation, Trelleborg has cemented itself as a global leader in advanced polymer technology. In recent years, the company has shifted its focus toward high-value-added applications, divesting from lower-margin businesses to strengthen profitability and market position.

In 2024 Trelleborg announced 7 acquisitions, with 5 acquisitions announced in both 2023 and 2022 and no less than 9 deals announced in 2021. The company targets 8% annual sales growth with constant currencies of a business cycle.

Trelleborg Stats as of Feb 3, 2025:

Stock Price: SEK 414.40

Market Capitalization: SEK 88.3 billion ($8 billion)

Dividend Yield: 1.8%

Forward Price-to-Earnings (P/E) Ratio: 20

Estimated Revenue Growth (2025): 8.4%, reaching SEK 37 billion

Estimated Free Cash Flow per Share (2025): SEK 24

Dividend per Share (2024): SEK 7.50 (up 11.1%)

Annual Share Buybacks: 5-6% reduction in shares outstanding

EBIT Margin: Currently 16-17%, expected to grow to 18%

Return on Invested Capital (ROIC): 9.8% in 2024, projected to rise to 12% in the next couple of years

Years of increased dividends: 4 (Trelleborg suspended the dividend for FY 2019 because of the covid pandemic, but picked up the annual dividend growth with a new record high payment for FY 2020). In fact Trelleborg did 14 dividend hikes in the last 16 years.

Even with all the acquisitions and annual buybacks Trelleborg manages to keep a strong balance sheet.

Current Operations

Trelleborg specializes in polymer-based engineered solutions that enhance performance, durability, and efficiency across various industries.

Trelleborg has operations in 40 countries worldwide with a total number of 15,646 employees. The company operates through multiple segments, including:

Sealing Solutions: Custom elastomer and thermoplastic seals for industrial, automotive, and aerospace applications. These include hydraulic seals, O-rings, and advanced sealing systems used in high-pressure environments.

Industrial Solutions: Protective and anti-vibration systems for construction, infrastructure, and heavy industry. These products include bridge bearings, tunnel seals, and shock absorption solutions.

Aerospace and Automotive Components: Trelleborg provides lightweight, high-performance polymer-based parts for aircraft and vehicles, including noise-dampening systems, fuel line components, and advanced sealing solutions.

Marine and Offshore: The company manufactures dredging hoses, fender systems, and other marine-related products that help protect port structures and ensure safe marine operations.

Healthcare & Medical Solutions: Specializing in biocompatible elastomers and medical-grade polymers, Trelleborg supplies custom solutions for medical devices, pharmaceutical processing, and wearable technology.

Competitors: Trelleborg faces competition from global industrial materials companies such as Contitech, Freudenberg, Hamilton, Hutchinson, Parker Hannifin, Roxtec, Saint Gobain and SKF.

Economic Moat: The company's moat lies in its specialization in high-performance polymer solutions, long-term client relationships, and technical expertise. Its presence in mission-critical applications gives it pricing power and brand strength in its niche markets.

We like the stock because of its strong historical track record of dividend growth and robust cash generation, which enables Trelleborg to continue repurchasing shares, increasing its dividend, and making multiple acquisitions each year. In fact, this closely aligns with what Parker Hannifin—one of our favorite stocks, also included in our dividend portfolio—has been successfully doing for years. A similar U.S. stock that was previously a Focus stock is Mueller Industries (MLI).

There are currently 10 analysts covering the stock: 3 buy recommendations and 7 hold ratings. After a double-digit price increase in 4 of the last 6 years, the stock has an estimated P/E ratio of over 20 for 2025. This compares to 26.4 for Parker Hannifin at a stock price of $696. The market cap for Parker Hannifin is $91 billion.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.