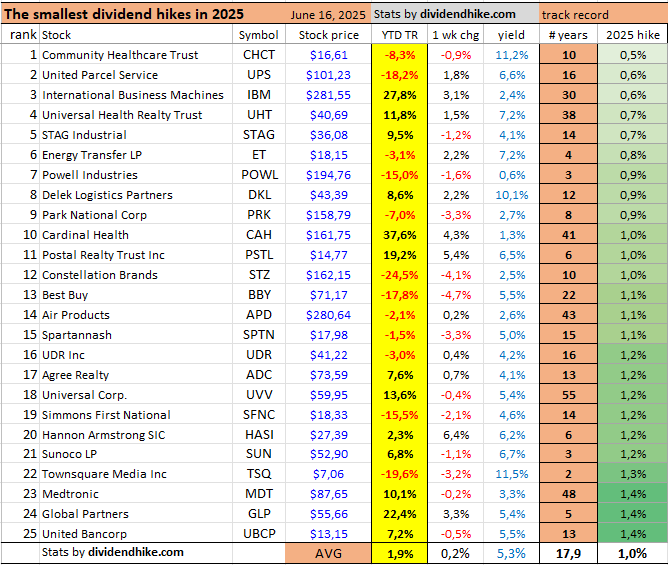

The smallest dividend hikes in 2025

25 U.S. Companies with Dividend Increases of 1.4% or Less YTD

At DividendHike, we usually focus on the biggest dividend increases — but this time, we're flipping the script. We're zooming in on the SMALLEST dividend hikes of 2025.

"We don’t just like dividend growth — we crave double digits. Meet the elite: 10+ years of 15%+ annual dividend hikes. We call them what they are — THE DIVIDEND HEROES."

And what do we find? A whole bunch of well-known names delivering minimal dividend increases. The smallest one so far in 2025 comes from Community Healthcare Trust (CHCT), which raised its dividend by just 0.5%. Still, that marks the 10th consecutive year of dividend growth — so consistency is key.

What stands out is that most of these small hikes come from companies with long and solid dividend growth track records — often 10 years or more. And that makes perfect sense: they want to protect that streak.

Take Air Products, a Dividend Aristocrat. In 2025, it raised its dividend by only 1.1%, but that modest bump extends its growth streak to an impressive 43 consecutive years.

On average, these “smallest hikers” boast nearly 18 years of uninterrupted dividend increases.

Some big names on the list include:

United Parcel Service (UPS): +0.6%

IBM: +0.6%

Medtronic: +1.4% — another Aristocrat, now hitting 48 years of consecutive hikes

Another thing that jumps out? These stocks offer a high average dividend yield of 5.3%. That’s no surprise — stocks with high yields tend to show little to no dividend growth. We’re seeing that pattern clearly here.

There’s also a performance angle: small dividend hikes often come with weak stock performance. These 25 “smallest hikers” have an average year-to-date return of just 1.9%.

So far in 2025, we've counted 495 dividend increases in the U.S., and this list represents the weakest of the bunch. We've also seen 21 dividend cuts or suspensions — a reminder that not every dividend story is a happy one.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.