U.S. Dividend Hikes – Week 40 of 2025

Starbucks, Honeywell, Accenture, Philip Morris and Texas Instruments are headlining

The first week of October and last weeks of September brought a fresh wave of dividend increases across U.S. markets, led by household names spanning coffee chains, industrial powerhouses, tech consultants, and consumer staples. From Starbucks to Honeywell, Accenture, Philip Morris International, and Texas Instruments, corporate America continued to reward shareholders with higher payouts — a sign of confidence as the economy transitions into the final stretch of 2025.

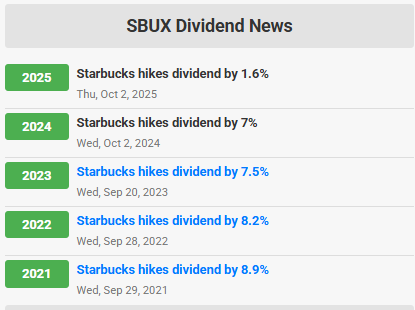

Among the week’s highlights, Starbucks delivered another step-up in its annual payout policy. According to DividendTrackRecords.com, the coffee chain raised its quarterly dividend by 7.5 %, lifting it from $0.57 to $0.613 per share. This marks Starbucks’ 15th consecutive annual increase, underscoring the company’s strong cash generation and enduring brand resilience. Even amid fluctuating consumer spending, the Seattle-based group continues to translate growth into consistent shareholder returns.

For the full list of dividend hikes check www.dividendtrackrecords.com

Industrial heavyweight Honeywell International extended its own impressive streak. As reported by DividendTrackRecords.com, the company boosted its quarterly payout by 5.3 %, from $1.13 to $1.19 per share. Backed by robust free cash flow from its aerospace and automation segments, Honeywell now boasts 15 consecutive years of dividend growth — a hallmark of stability in the U.S. industrial sector.

In professional services, Accenture maintained its pace of double-digit dividend growth. DividendTrackRecords.com notes a 10.1 % increase, bringing the quarterly payout from $1.48 to $1.63 per share. The move reflects management’s confidence in recurring revenues and its global client base. Even in a shifting macro environment, Accenture continues to balance reinvestment in digital capabilities with a strong commitment to returning cash to shareholders.

For Philip Morris International, dividend dependability remains a defining feature. As detailed by DividendTrackRecords.com, PM lifted its quarterly payout by 8.9 %, from $1.35 to $1.47 per share — one of its most generous raises in recent years. While the company continues to pivot toward reduced-risk products, its dividend policy remains steadfast, supported by strong pricing power and stable global demand.

Finally, Texas Instruments once again stood out in the semiconductor space for its disciplined approach to capital returns. Based on DividendTrackRecords.com, TI raised its quarterly dividend by 4.4 %, from $1.36 to $1.42 per share, marking 22 consecutive years of increases. Although growth in recent years has moderated, the consistency underscores Texas Instruments’ focus on long-term value creation, even within a cyclical industry.

Across the broader market, other U.S. companies — including RPM International, American Financial Group, OGE Energy, WP Carey, and Worthington Enterprises — also joined the list of dividend growers this week. Together, these announcements reflect the depth and durability of America’s payout culture: a blend of cautious optimism, disciplined capital allocation, and a steady hand in uncertain times.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.