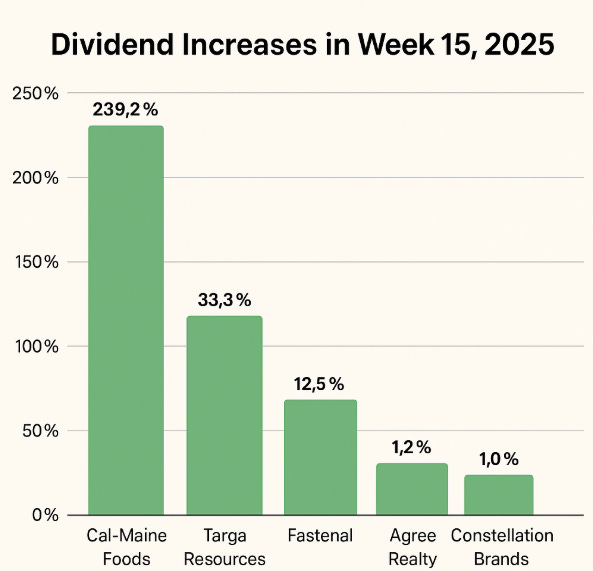

USA Dividend Highlights: Week 15, 2025

Dividend Aristocrat Fastenal and egg producer Cal-Maine stand out

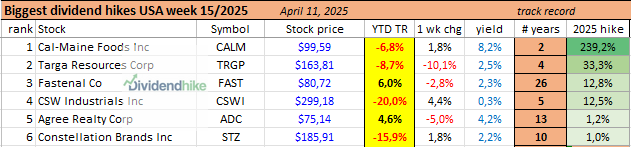

Last week (From April 7-11, 2025), several U.S. companies announced their dividend hikes, signaling ongoing commitment to shareholder returns despite varying performance across sectors. Below, we take a closer look at these companies' dividend increases, providing insight into their stock price movements, dividend yield, and market capitalizations.

Fastenal Company FAST 0.00%↑ , a proud Dividend Aristocrat, is once again rewarding its shareholders — announcing a 2.3% increase to its quarterly dividend, now set at $0.44 per share. This marks the second dividend increase in 2025, bringing the year-to-date dividend growth to an impressive 12.8%.

Fastenal’s commitment to shareholder returns is no passing trend. The company began annual dividends back in 1991, upgraded to semi-annual in 2003, and transitioned to quarterly payouts in 2011. Over the years, shareholders have also benefited from four special one-time dividends — most recently in December 2023.

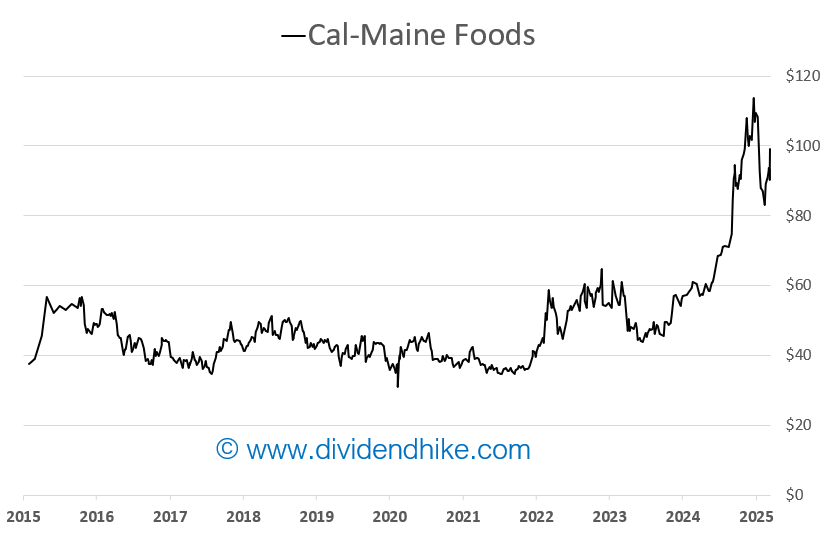

Cal-Maine Foods Inc. CALM 0.00%↑ , a leading player in the packaged foods and meats sector, raised its dividend by an impressive 239.2%. Cal-Maine announced a new quarterly dividend of $3.456 per share, marking its second dividend increase of the year.

Following a 46.2% increase in Q1, the company is now raising the dividend by an additional 132%, resulting in a year-to-date increase of 239.2%. As is well known by long-time followers of Cal-Maine, the company operates a variable dividend policy, tying its payout directly to earnings.

The higher the earnings in a given quarter, the higher the dividend. Cal-Maine has benefited significantly from elevated egg prices in recent quarters, which has driven profitability — and therefore dividend levels — to new highs. It is important to note that future dividend payments will continue to depend on quarterly earnings. The recently declared $3.456 dividend does not guarantee similar payouts in future quarters.

Targa Resources Corp. TRGP 0.00%↑ , involved in oil and gas storage and transportation, announced a 33.3% increase in its dividend. The stock price is currently at $163.81, with a dividend yield of 2.5%. Despite recent fluctuations, the company’s 4 years of dividend increases reflect strong fundamentals in the energy sector. The dividend yield stands at 2.5%, with a market cap of $36 billion, making Targa a significant player in its industry.

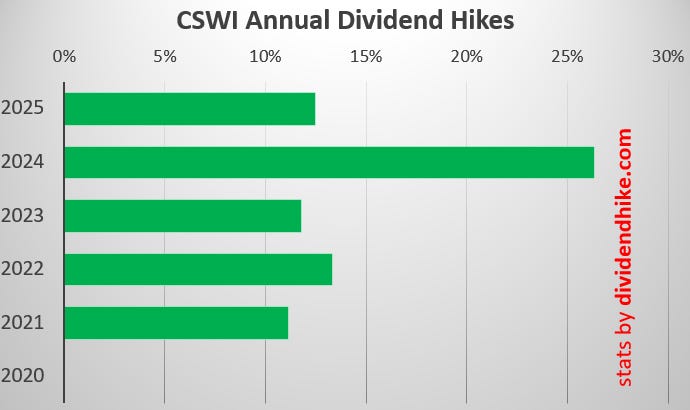

CSW Industrials Inc. CSWI 0.00%↑ , which operates in the building products industry, increased its dividend by 12.5%. The stock price of CSW Industrials is $299.18, with a relatively low dividend yield of 0.3%.

Despite this, the company’s 5 years of consecutive hikes indicate confidence in its financial stability. With a market cap of $5 billion, CSW Industrials is focused on long-term shareholder value despite recent stock price challenges.

Agree Realty Corp. ADC 0.00%↑ , a shopping centers REIT, boosted its dividend by 1.2%. The stock is priced at $75.14, with a dividend yield of 4.2%. With 13 years of dividend growth, Agree Realty continues to offer a solid dividend yield. The company’s market cap is $8 billion, reflecting its strong position in the retail real estate sector and its ability to generate reliable income streams for investors.

Finally, Constellation Brands Inc. STZ 0.00%↑ , a leader in the alcoholic beverages sector, raised its dividend by 1.0%. The stock price sits at $185.91, with a dividend yield of 2.2%. With 10 years of consecutive dividend hikes, Constellation Brands continues to deliver value to shareholders.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.