Yes, Eli Lilly Is in Our Portfolio

Top U.S. pharma pick for its rebound potential, innovation, and unmatched dividend growth.

The Dividend Hike Portfolio staged a strong comeback this week, fueled by several standout performers — chief among them: Eli Lilly LLY 0.00%↑.

We didn’t add LLY to the portfolio earlier this year for nothing. After a sharp correction in its stock price, we saw a golden opportunity. From both a growth outlook and dividend growth perspective, LLY remains the premier pharmaceutical stock in the U.S. market. That call is now paying off — and then some.

Eli Lilly closed higher 14% at $839.96 on Thursday alone, following explosive news from its latest trial results. To quote the headlines:

"Shares of drugmaker Eli Lilly (LLY) rose 15% to $845 its best one-day percentage gain in over a year. The company reported that its small molecule oral drug, orforglipron, led to an average weight loss of 7.9% and lowered blood sugar in overweight type 2 diabetes patients in a late-stage trial."

This is a game-changer. Even with a P/E of 38, the valuation looks justified — because this company is growing fast. Revenue is expected to jump 32% in 2025 to $59.5 billion, with at least 15% annual growth forecasted for 2026 and 2027. And thanks to orforglipron, those numbers could prove conservative.

Yes, the dividend yield is modest. But make no mistake: LLY is a dividend growth monster. No other pharma comes close to matching Lilly's combination of growth, innovation, and consistent shareholder returns.

This is what long-term investing is all about: spotting value in quality during a dip, staying the course, and getting rewarded when the market finally catches up.

LLY is not just part of the portfolio — it’s one of the crown jewels.

In addition to Eli Lilly’s spectacular performance, Texas Pacific Land TPL 0.00%↑ also delivered excellent returns over the past week. We also saw a solid

rebound from EOG Resources EOG 0.00%↑ , while Abbott Laboratories ABT 0.00%↑ surged on the back of strong earnings. Abbott continues to prove itself as one of the top Dividend Aristocrats of 2025 — combining reliability, steady dividend growth, and resilience in uncertain markets.

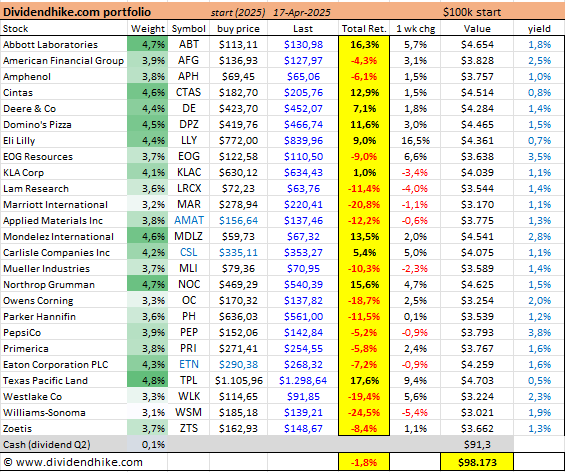

Below is the full Dividend Portfolio as of April 17, 2025.

For now, we remain satisfied with the portfolio composition and will not be making any changes. If you have any questions about the portfolio or a stock, please leave us a message by chat or email!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.